Trends in financial technology are setting the pace for a global transformation that is changing the way we manage our money.

Have you wondered how the evolution of the fintech world could impact your finances in 2024?

Many say that the future of the fintech world will be loaded with technological innovations never seen before.

Today, we want to tell you that the future is already here, and the best part is that its control can be completely in your hands.

Now you can manage your finances with greater ease, security and efficiency, while at the same time entering a vast ocean of financial possibilities.

In the past, converting traditional fiat money into digital assets was virtually unthinkable.

Today, it is a palpable reality, thanks to the efforts of companies such as NOBA.

Lately, more companies are prioritizing your financial freedom in the fintech ecosystem, through platforms that guarantee the security of your financial transactions.

But there is more.

These are also the companies that make you feel part of a totally historic digital and financial revolution in the Latin American and global scenario.

Although it should be noted that in this context, you also play a vital role.

In what way? Undoubtedly, it is your responsibility to be aware of the advances and developments that are shaping the fintech landscape, because only then will you fully understand how they can benefit you in your day-to-day life.

Read on to find out how you can stay one step ahead in the financial world of the future!

2 financial technology trends you should be aware of in 2024

1. Generative artificial intelligence

Generative artificial intelligence (AI) is profoundly transforming the financial sector by introducing innovative solutions that change the way institutions manage and personalize their services.

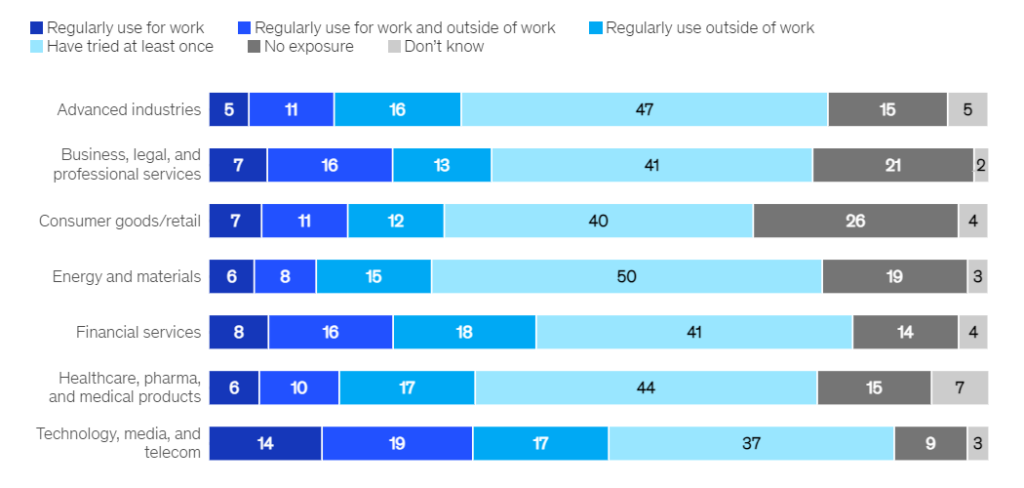

McKinsey & Company, contemplates in The State of AI in 2023, that the business functions that most commonly use these newer tools are the same ones where AI use is most common overall.

Are you able to anticipate the industries that are benefiting the most from the adoption of artificial intelligence in 2024?

If you thought about the financial services market, then you hit the bull’s eye.

The data in this chart from McKinsey & Company is revealing and compelling, as it confirms that AI is revolutionizing the financial and technology sector at an unprecedented rate this year.

How does AI work in financial management?

Now, what do AI advances and their impact on the fintech world look like in real life?

If you had that question in mind, pay attention to the following information about the role of AI in this vibrant ecosystem:

1. AI accelerates real-time data analysis

AI algorithms are capable of processing large volumes of data at a speed that far exceeds human capability.

This allows financial platforms to analyze transactions and patterns in real time.

For example, systems can identify unusual patterns in financial behavior that could indicate fraud, acting preemptively before problems materialize.

2. Facilitates and promotes personalized recommendations

Using historical and behavioral data, AI is able to offer personalized investment recommendations and financial strategies.

Algorithms learn from the user’s past decisions and adjust suggestions based on changes in the market or user preferences.

The result? It’s straightforward and simple: more adaptive and accurate investment management.

3. Increased efficiency in risk management

AI also plays a crucial role in financial risk management. How? In essence, predictive models can:

This allows you to adjust your investment strategies, while mitigating your risks in a more timely, intelligent, automated, strategic and effective manner.

4. Increased process automation

AI-based automation can significantly reduce the need for manual intervention in repetitive financial processes, such as:

- Account reconciliation.

- Generation of highly rigorous and exhaustive reports.

This not only improves operational efficiency, but also reduces the possibility of making human errors that can cost you a lot of time and money.

Do you now better understand why at this point in history, if we are talking about trends in financial technology, it is imperative to bring to the table the impact AI is having on the industry today?

2. Expansion of Decentralized Finance (DeFi) platforms

Decentralized finance, or DeFi, continues to gain traction and is shaping up to be one of the most prominent financial technology trends of 2024.

These platforms use blockchain technology to offer financial services without the need for traditional intermediaries.

What does this mean? Basically, they reduce costs and increase accessibility.

Through them, users can access loans, exchange assets and participate in investment protocols directly from their digital portfolios.

With the growth of DeFi, further democratization of financial services and greater transparency in transactions is expected.

According to figures from Statista, one of the world’s most prestigious statistics portals, in terms of global comparison, the United States leads the way with the highest revenues in the DeFi market, reaching US$73,350.0k in 2024.

These figures reveal an unvarnished truth: decentralized finance is becoming increasingly relevant and necessary for users in their day-to- day lives.

Are you really in control of your financial future?

Trends in financial technology for 2024 are redefining the financial management landscape and opening up new possibilities for individuals and businesses alike.

From the adoption of artificial intelligence, to the expansion of decentralized finance, these innovations are designed to offer greater efficiency, security, and personalization in your financial operations.

Companies like NOBA are at the forefront of this fintech revolution, offering advanced solutions that facilitate conversion between fiat currencies and cryptocurrencies, as well as secure, transparent and hassle-free international transfers.

With a secure and easy-to-use platform, NOBA allows you to stay up to date with the latest financial technologies.

So, the ultimate question to ask yourself right now is: Are you really in control of your financial future?

If your answer was no, we can only tell you this: Don’t let traditional banking limit your possibilities.

Join the fintech revolution with NOBA and discover how you can take advantage of these trends to optimize your asset management and achieve true financial freedom.

The future of your financial management is here, and it is at your fingertips, take advantage of it!